Mainstay Hail - Parametric Insurance For Dealerships

When it comes to hail cover for dealerships, it's never been an easy process. You can only get a small amount of cover, the premiums are expensive and becoming more so, there's a reasonable sized excess for each vehicle that is damaged, you need to wait to have someone assess the damage and then negotiate with the insurer as to when your vehicles will be repaired.

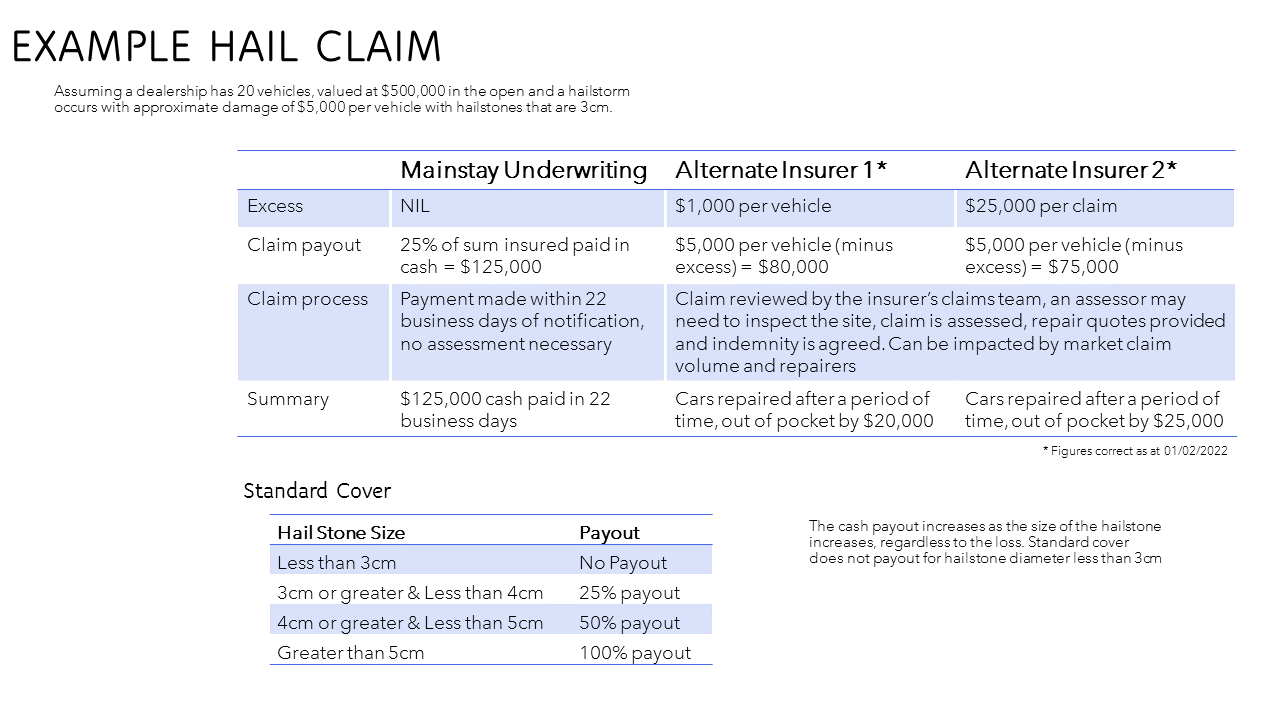

With a traditional property insurance policy your client pays their premium to cover them for a range of possible events, where the insurer will repair / make good as necessary, putting them back to their original position before the event occurred. Whereas a Parametric policy is based on an agreed event occurring (the Trigger) and the policy will then make a cash payment to your client based on an agreed payout schedule. For the Mainstay Underwriting hail policy, the trigger is the size of a Hailstone being in excess of 3cm. A hailstone that is less than 3cm in size will cause little to no damage, but above 3cm the policy will make cash payments to cover the costs your client will have to incur, with the cash payout amount increasing as the size of the hailstone increases.

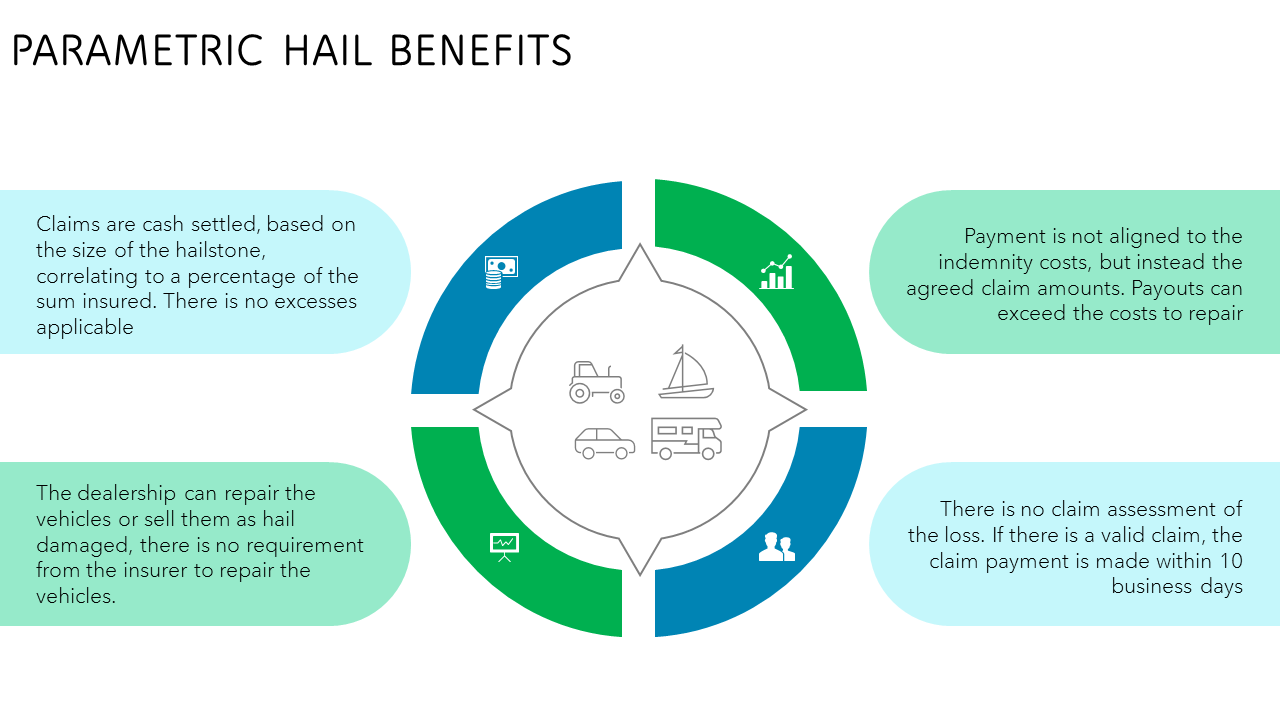

The parametric policy benefits include:

Just like the Uber / Taxi paradigm shift, parametric cover is a new and more affordable way of covering your hail risk. With our dealership experience, Mainstay Underwriting has developed the best solution to cover your Dealerships.

To get a quote, please complete the hail section within our Dealership proposal form, that can be found in our downloads section. If you have any questions on the product, please read our FAQ’s below or call our office to discuss.

FAQ's

What is Parametric insurance?

Parametric insurance is a non-traditional insurance product that offers pre-specified payouts based upon a trigger event.

With a traditional property insurance policy your client pays their premium to cover them for a range of possible events, where the insurer will repair / make good as necessary, putting them back to their original position before the event occurred. Whereas a Parametric policy is based on an agreed event occurring (the Trigger) and the policy will then make a cash payment to your client based on an agreed payout schedule. For the Mainstay Underwriting hail product, the Trigger is the size of a Hailstone, where up to 3cm in size will cause little to no damage, but above 3cm the policy will make cash payments that increase in amount depending on the size of the hailstone.

Benefits of Parametric insurance is there’s no excess, there’s no claims investigation / adjustments, not subject to underinsurance, an immediate cash payment is made keeping cash flow strong and the policyholder is in control.

What's the benefits of a Parametric Hail policy for dealerships compared to a traditional policy?

A parametric insurance policy is based off an event occurring. In this case if a dealership is hit with hail that is of a particular size, a claim payment is made to the dealership. A specialised hail analysis device (Hailios) at the dealership will record the size of hailstones during a hail event and depending on the size of the hailstones, the insurer will make a cash payment to the dealership. There is no assessments required and there is no excess payable, it’s a very simple exercise.

Whereas, current traditional hail policies are generally based on the sum insured of all vehicles in the open or limited in the total sum insured available to the dealership. This has the effect of increasing the premium of the policy or not providing sufficient cover.

Other points for a traditional hail policy include:

- There will be an excess based on the number of vehicles damaged by the hail, generally $1,000 per vehicle and capped to $50K - $100K.

- The insurer will need to send a claims assessor to the site to examine the damage. The issue is that there will be a large number of vehicles damaged in the suburb, so this could take a while.

- The sum insured can be subject to underinsurance, which means the insurer can reduce the settlement based on the sum insured versus the actual values.

- There could be a negotiation on the claims settlement, this might be different to what the dealership believes and a dispute occurs.

What is the Mainstay Underwriting model?

Mainstay Underwriting has worked with our global insurers to develop a specific hail product for the Australian Motor Dealership industry that provides parametric protection for dealerships. We have also partnered with the Hail Response Team, a national hail dent repairer to provide specialised hail repairs for your dealers. Under the terms of the policy, subject to policy conditions, the insurer will make an immediate cash settlement (per policy conditions) to your client and we will provide you the details of our PDR Partners that you can engage with to repair your vehicles. This provides your client with complete control over the way the repairs are conducted, whilst allowing for continued cash flow for their business.

What sum insured should your client elect?

Unlike traditional indemnity cover, your client needs to take into account what vehicles are exposed, the likely repair costs for a small and large hailstorm and then align that with the payouts. If a minor hailstorm was to hit and there was minimal damage to the vehicles, would the 3-4cm hail payout be sufficient to cover the costs? Likewise a large hailstorm, versus the 4-5cm payout. If you get the ratio correct, your client will have the cover they need for repairs, related costs and down time, without paying too much for the cover.

How much will the Parametric Hail cover cost?

The cover will depend on where in Australia your client's dealership is located. If your client's dealership is located in the main hail-belt through NSW, the costs will be higher to dealerships than in other locations. If you would like to discuss indicative prices, please call our office and we would welcome a discussion with you on your client's needs.

Please note that our Hailios IoT devices are an annual static cost and for new covers the annual fee is an immediate payment. We will request confirmation from your office that you have received the non-refundable payment for this device, and the parametric insurance can be premium funded within Mainstay Underwriting's credit terms.

What are the triggers and the claim payouts?

The Mainstay Underwriting product uses a Hailios Hail device to determine the size, velocity and intensity of the hailstorms that occur. Using this device our parametric policy will make claim payments based on the following triggers as detected.

STANDARD COVER

| Hail Stone Size | Payout |

|---|---|

| Less than 3cm | No payout |

| 3cm or greater & Less than 4cm | 25% payout |

| 4cm or greater & Less than 5cm | 50% payout |

| Greater than 5cm | 100% payout |

Please note, depending on the level of cover chosen, if a hail storm occurs and the size of the hail stones are less than the minimum size of 3cm, there will be no payout, even if there was damage to your stock.

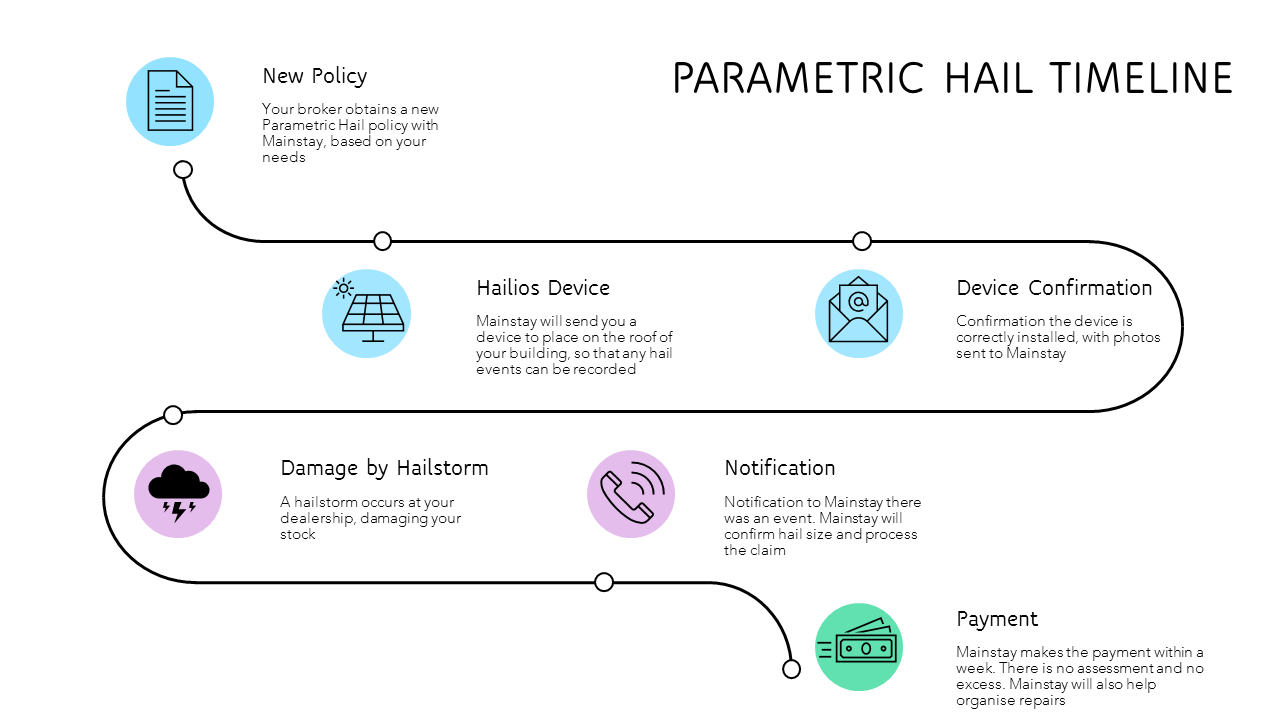

What is the process to bind a hail policy?

We will need you to complete our Dealership proposal form, including the Hail section, highlighting any prior claims made at that location for hail. We will underwrite your total dealership risk, whilst also providing you an indicative quotation on the hail cover. If the indicative is acceptable we will provide you with a formal quotation from the insurer(s) for you to bind cover on. Whilst these covers are separate, Mainstay Underwriting is offering the hail policy as part of the dealership package. Once the policy is bound, we will arrange for our Hail Detection Device to be shipped to your client to install the device as required. Hailios will calibrate their device (within one business day) and the hail policy is live.

Hail timeframe quotation is as follows:

- Broker provides the Dealership proposal form to Mainstay Underwriting.

- Hail indicative quotes are reviewed by the insurer's underwriting committee in Europe every Monday night, provided to brokers the next day.

- Once the broker confirms the indicative quote, Formal Terms will take up to 5 business days.

- Where formal terms are agreed, documentation will be provided to the broker within 5 business days.

- Hailios will courier the device(s) to site, where the policyholder needs to install the device and provide Exhibit A & B from the wording.

- Within 1 business day, Hailios will activate the device .

What is the claims process?

If a hailstorm event occurs and you suffer any damage, please call your insurance broker and let them know. They will then raise this with us and we will evaluate the information provided by the onsite Hailios units. If the size of the Hail stones were greater than 3cm we will issue a Mainstay Hail Claims Declaration form for you to complete, confirming there is damage at your dealership. Mainstay Underwriting will work with the insurer to arrange for the cash payout to be made, as per your policy wording. Mainstay Underwriting will also provide you information on our partner, the Hail Response Team, a professional Paint and Dent Removal company that will assist you with a hail repair team to repair your vehicles.

Please remember that the maximum benefit paid will be as per the payout figure of your policy, not the indemnity value to repair the vehicles.

How does a parametric claim event differ from a traditional hail claim

The core difference is that the claim is not based on the actual damage caused, but instead to the most likely costs based on the size of the hailstone. In this example, if a hailstorm occurs there is no need to assess the extent of the claim as it's already agreed to be 25% of the sum insured (based on the claim payout matrix). The dealership is paid a cash settlement and there is no requirement to assess any damage or repair the vehicles.

Conversely a traditional insurer needs to understand the extent of the damage, get quotes to repair the vehicles and then complete the repairs. Not only will this take some time to complete, the dealership will also need to pay the excess applicable to the claim. The net result is the dealership is out of pocket each time a hail claim is made, cashflow halts, and the opportunity to purchase replacement stock quickly is lost.

After a Hail event, am I still covered for Hail?

Your policy covers you for the total sum insured you have elected. If during the policy term you have a hail claim and a payout of 25% is triggered, your policy will continue but the overall aggregate cannot exceed the policy sum insured.

As an example, you take a Mainstay Hail policy with a sum insured of $1M and you have a claim where the hail stones are recorded at 3cm. The insurer will make a payment of $250,000 to the Policyholder and the policy aggregate limit will reduce to $750,000. Should a further claim occur in that policy period for 5cm hailstones, the maximum claim payout will be $750,000.

Mainstay's Hail Response Team

Mainstay have partnered with HRT, a leader in hail repair and paintless dent removal. Their expert team has been carefully trained using state-of-the-art techniques and will respond to hail events across Australia.

For more information, please visit their website - www.hailresponseteam.com.au

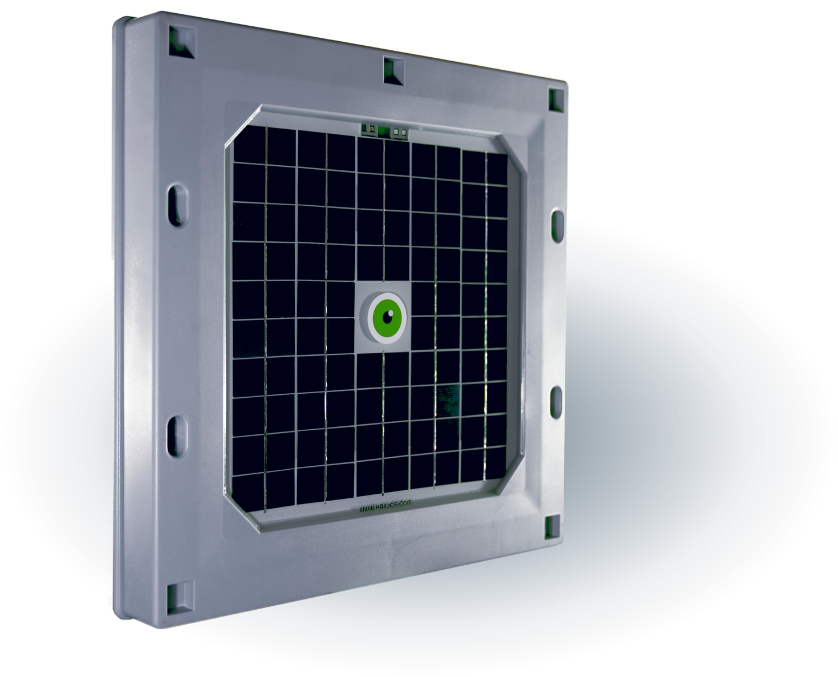

Mainstay's Hail Detection Device

Mainstay Underwriting have partnered with Hailios, a technology company that works with the biggest global insurers, including Lloyd's syndicates, Munich Re, Swiss Re, AXA, AON, Generali and Berkshire Hathaway. The Hailios device is a self-contained and autonomous device that is solar powered and has no wires. It's placed on the roof of the Dealership building and depending on the size of the dealership, will depend on the number required. This device will accurately measure the size of any hailstones that hit the site, so it’s important the device is not placed near any obstructions.

The Hailios hail device will be sent directly to the Dealership from our supplier. Once the device has arrived at the Dealership, Mainstay will arrange for a tradesman to place the device onto the roof, there is no cost to the policyholder for this to occur. The device has a mat that will stick it to the roof of the building and requires little fuss to install. If there is any damage or if the unit is stolen, please contact Mainstay Underwriting immediately so that we can arrange for a replacement to be shipped. Each device contains a number of security devices, so whilst we will be able to find the unit, we will arrange for a new device to be shipped at no additional cost. Please note, any future maintenance work to the roof or items on the roof, must not obstruct the device or this could adversely impact the ability for the Hailios device to measure the hailstones.

This Hailios device is required for hail confirmation, so when the device arrives, it is necessary to install it as soon as possible. For any hailstorm events that occur, we will provide you copies of the data reports for your records.

For more information, please visit their website - www.hailios.com

What if the Hail Detection Device is damaged or stolen?

The Hailios device is managed remotely and should the device be moved or attacked, Hailios will notify us. However, if there are any issues with the device, Hailios will ship a replacement device directly to the PolicyHolder. If a device is inactive during a hailstorm, Hailios have backup system with the usage of commercial radar data.

Case Study

A dealership in the western suburbs of Sydney has $4Million of vehicles in the open. They have a number of quotes where the rates are either in excess of 6% first loss with an event limit restricted to only $500,000 or they’re based on the full sum insured in the open, making the premiums significant either way. Furthermore each insurer has an excess that is applied to either each vehicle with an aggregate excess per claim, or an upfront excess.

The holding broker approached Mainstay Underwriting to provide a dealership quote that includes Parametric Hail, however the dealership only wants to cover a first loss of $2.5Million. The Mainstay dealership policy is exceptional, but now with a hail rate of significantly lower than 6% in the Sydney western suburbs (all locations in Australia are separately rated) as well as a nil hail excess, it meets the needs of the broker’s client and cover is bound.

Some months later a Hailstorm hits the dealership where 200 vehicles are damaged. The broker notifies Mainstay there is a claim and provides the claim forms specifically required for the Parametric Hail policy. Mainstay reviews the claims data, confirms the hail size was 4cm from the Hail Device onsite and there is no claims assessment. 3 weeks later a cash payment is made to the dealership for $1.25Million. The Dealership engages Mainstay’s Paint and Dent Repair partner and decided to repair 100 of the vehicles at $5,000 each and the remaining 100 were sold with a $5,000 hail damage discount.

Unlike the old traditional style policies the dealership’s costs were $1Million, there was no excess like other insurer’s policies and the dealership gained an additional $250,000 to assist with their business interruption, likely increased costs of replacement stock in the post hail event vehicle market and advertising. Furthermore, as there were no claim assessments, the claim was paid within 3 weeks ensuring the business cash flow was not affected, compared to the traditional insurers where vehicle repairs can take months and the vehicles that are considered uneconomical to repair are sold at auction.